From grudge purchase to grand purpose: Why insurance products can sell a better world

Insurance isn't just dull, right? It's painfully dull. The most grudging of grudge purchases. The grimmest of obligations. Insurance is right down there with dental fees, toilet paper and fixing the fridge. Worse, if anything, since it will probably be years before you receive anything tangible in return. And it's only if you're very lucky that all those monthly premiums will have been for nothing at all.

We all know insurance has a bad rap. But I don't think it deserves it. In fact, I think insurance isn't painfully dull; it's fundamentally a force for social good. It brings invaluable order in times of chaos. More than many sectors, insurance has the opportunity to credibly deliver on social purpose in a market that can seem stressful and confusing. In an increasingly chaotic world, there's a lot for insurance companies to offer – and to gain.

The quest for order and a free Parker pen

Living in the 2020s it feels like an increasingly urgent need for order in an ever more chaotic world. The climate emergency, threats to democracy, economic inequality, wars in Ukraine, Sudan and Yemen, crisis upon crisis – of refugees, mental health, social media and discrimination. People want to help. But finding the best ways can seem complex and overwhelming. So, increasingly, they crave brands and products that can show them the way.

Helping provide order amid chaos cuts to the core of insurance companies’ purpose. They understand that most of us strive to live orderly lives, but that from time to time, the unexpected happens. A burglary, a car accident, a death in the family – devastating life events that turn our worlds upside down. These are the times we turn to insurance to be our rock. However grudgingly we view it, insurance delivers when it matters. The order restored by insurance is a powerful force for good when chaos strikes.

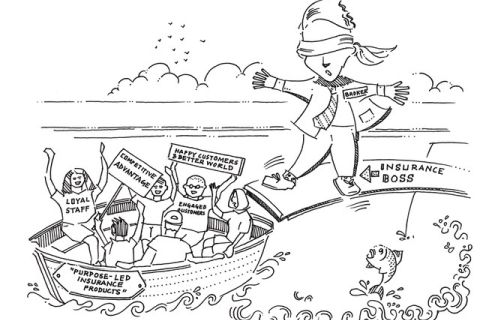

It might follow that insurance brands leverage this benefit to develop new purpose-led products – products that deliver an ordered way for customers to navigate the complex world of doing social and environmental good. But all too often, I see insurance companies seeking marginal gains through familiar product improvements, such as customised coverage options, flexible payment plans and enhanced digital experiences. It's little wonder insurance advertising parades weird and wonderful characters to create interest: a bulldog, meerkats, an opera singer, a sea admiral, a small red 1980s telephone… they brighten a world in which a free pen still represents dream fulfilment.

But there's a huge gap between the creativity of the advertising and the sameness of the products. I understand that extensive regulation and complex underwriting processes inhibit change, but they shouldn't hinder innovation. A head of sustainability in the financial services sector told me recently that their average home insurance customer engages with them for just seven seconds a year! The sector is crying out for new ways to improve customer engagement. And their customers are crying out for brands to engage them in social purpose with products that deliver. The opportunity is here for the insurance brands willing to grasp it.

Why your purpose-led insurance product could be bigger than The Beatles

Business innovation is often framed in terms of order and chaos too. Charles O'Reilly, Professor of Management at Stanford business school, says, 'From chaos comes creativity, from order comes profit'. Essentially, you need a little of both. Yes, order provides welcome predictability and safety, but it can also be staid and hamper growth. Chaos is risky and loosens control, but it also offers potential for new opportunities. The trick is finding the right balance. But most often, innovation involves some kind of leap of faith.

The list is long of businesses caught out by being too afraid to make leaps of faith. In 1962, Decca record executives turned down a promising new act called The Beatles because they thought guitar groups were a passing fad. In 1975, Steven Sasson developed the first ever handheld digital camera, but his employers, Kodak (remember them?), chose not to develop it for fear of cannibalising their lucrative film business. In 2004, Ari Hakkarainen unsuccessfully pitched a new generation of mobile phone, called the smartphone, to the management team at Nokia, a whole three years before the launch of the first Apple iPhone.

But when it comes to taking the plunge with social purpose in 2023, financial services management teams have a massive advantage over their historical counterparts at Decca, Kodak and Nokia – because they can be confident in the knowledge that purpose-led businesses thrive.

A recent Fortuna report showed that high-purpose brands will double their market value more than four times faster than low-purpose brands. According to Accenture, over two-thirds of financial services marketers worldwide are using brand purpose to gain competitive advantage. In 1962, the jury was out on rock'n'roll's staying power. In 2023, the verdict has already been cast on the importance of purpose for financial services companies. Yes, customers will see straight through brands that fail to deliver on their social and environmental promises. But insurance companies – especially heritage insurance companies – are known for reliably producing the goods when it really matters. Well, it really matters for society and the environment right now. And your customers will reward you for taking action.

Creating new purpose-led insurance products is among the most low-risk, evidence-based leaps you can make.

Reject the chaos. Change the world!

New disrupter brands Lemonade and Algbra, who both put purpose at the core of their mission and products, are embracing the chaos. Lemonade tells us to Forget Everything You Know About Insurance. For them, the only way financial services brands can talk credibly about doing social and environmental good is to abandon what’s gone before. But what if we’re a little prouder of the contribution insurance has always made? What if, instead of abandoning everything insurance represents, we celebrate it?

Embracing purpose shouldn’t mean bringing chaos to a sector defined by its orderliness. Embracing purpose can be about enabling insurance products to do for the world what they already do for people: help bring order where there is chaos. And heritage insurance brands are ideally placed to develop products that carry this message. They are known. They are trusted. The message is much louder.

The best innovation products begin by focusing on what you already know. The most surefire way to secure competitive advantage is to align your purpose proposition with what your products do best. For heritage insurance companies, I think this is about unleashing the power of order and discovering the best way for them to apply it in the ESG space.

Your new purpose-led products must be about more than paying ethical lip service. More than marginal gains from the same token efforts. They must be about turning your impact strategy into meaningful action. Our average home insurance customers seven seconds was possibly not even long enough to even notice that a tree was planted the last time they renewed. But innovate to bake social and environmental benefits into every transaction and interaction, you will ensure richer and more long-lasting relationships across the customer experience. Customers are prepared to back sustainable products with their wallets as long as that product delivers on its promise. As Steve Jobs always said, it’s the quality of the product that counts.

People crave brand associations that represent their increasingly ethical values. And they want to spend money on products that sustainably do good. So, the case for purpose-led products is powerfully commercial as well as social and environmental. And no one knows better than trusted heritage insurance brands about how to deliver order where chaos and uncertainty reign.

So, let’s say goodbye to grudge purchases, and hello to engaged customers and a happier world.

--------

Ryan Bromley is a partner at Good Innovation.